Accounting source papers are a recorded document of all your business' transactions. You're probably going to be getting an onslaught of paperwork. On that note, the cheque should be different from a salary cheque, so your bookkeeper can easily categorize the expense in your books. This might include: Recording the details of your purchase on a spreadsheet (date, vendor, purpose, receipt), subsequently followed by an issuance of the reimbursement cheque. Reimbursing business-related costs should follow the same process as reimbursing your employees. Keep the business receipts and submit them to your accounting staff to reimburse you with a check. While this might seem insignificant, it's good accounting practice to record those expenses in your company's records. Many situations will arise where you'll have to shoulder miscellaneous costs out of your pocket. Don't Pay Business-Related Expenses Out of Your Pocket Instead, identify your needs first, so you can optimize your subscription costs and make the most out of the software.

Basic small business bookkeeping software#

Don't go buying the first software that comes up on your google search. When shopping around for accounting software, it's a good idea to consider your company's storage, accessibility, and security needs. Modern accounting software is more than capable of automatically calculating important financial figures while simultaneously organizing your spreadsheets. The accounting process is filled with repetitive tasks that can pile on and add unnecessary workload to your employees. With that said, automation feels right at home with small business bookkeeping. After all, when an AI is taking care of most of the mundane tasks in your company, you gather yourself time and money to grow other aspects of your business. Automate Repetitive TasksĪutomation has been dominating in many industries, and for a good cause. Tips for Getting Your Small Business Bookkeeping Started: 1.

Basic small business bookkeeping how to#

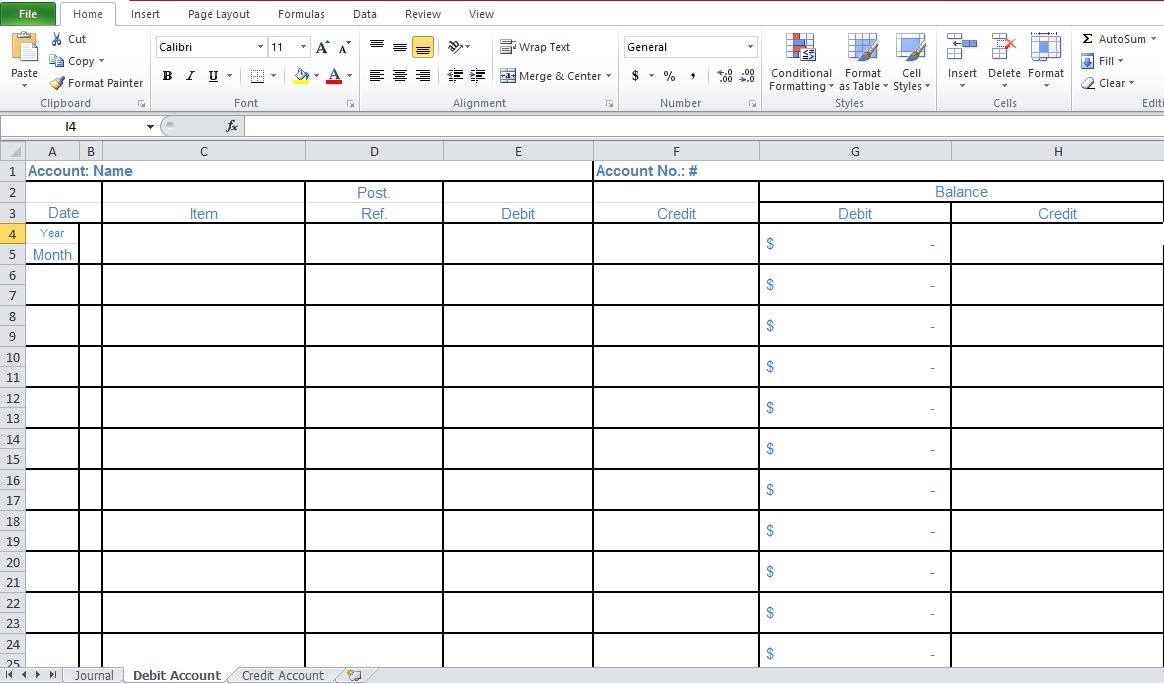

Bookkeepers must grasp the firm's accounting chart and how to manage the books using debits and credits. To report financial transactions, bookkeepers may use either single-entry or double-entry bookkeeping. Most companies now maintain accounts that display their financial expenses using advanced bookkeeping computer programs. That paperwork may be a receipt, an invoice, a sales order, or some form of the financial report demonstrating that the transaction occurred.īookkeeping transactions can be registered manually in a journal or inputted automatically using software such as QuickBooks bookkeeping services. Each financial transaction is registered based on supporting documents, depending on the type of accounting method used for the company.

What are Bookkeeping Tax Services?īookkeeping is the method of keeping records of any financial transaction made by a business from its inception to its closure. But first of all, let's make sure we're on the same page. Learn about the various options open to you and why it is essential to maintain accurate financial records. If learning the ins and outs of simple bookkeeping for small businesses sounds overwhelming, try to reel the information in slowly but surely. Understanding bookkeeping best practices and when to hire business bookkeeping services is critical for keeping the company going smoothly now and in the future, regardless of the type of business you manage. Bookkeeping that is accurate and up to date is the foundation of every profitable small business. To consistently stay on top of your business, you'll have to keep track of the inevitable accounting duties. Running a company is a never-ending stream of rewarding successes accompanied by ever-expanding to-do lists.

However, before you truly hit the road, you must lay some solid groundwork first. It must have taken months or years to get to where you are now, with loads of time to conceptualize and implement a business plan in between. Congratulations! Starting a new business is no small feat.

0 kommentar(er)

0 kommentar(er)